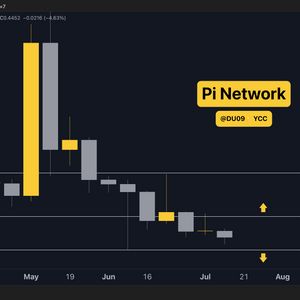

Popular investment firm Fidelity has become the largest shareholder of Japan-based Bitcoin treasury company Metaplanet. The company CEO, Simon Gerovich, disclosed this today on X, noting that the firm owns 12.9% of its shares. According to Gerovich , a limited liability company known as National Financial Services (NFS) LLC is the biggest shareholder in Metaplanet as of June 30. The company holds 130 billion Yen (approximately $820 million) shares. Interestingly, NFS is a subsidiary fully owned by Fidelity Investments and serves as custodian for shares bought through the Fidelity platform. Gerovich explained: “NFS is a wholly owned subsidiary of Fidelity Investments and typically acts as custodian for retail and institutional investors who purchase shares via Fidelity platforms.” Based on Gerovich’s explanation, Fidelity through NFS holds most of the shares in custody for customers who buy Metaplanet shares through the platform. While the Bitcoin treasury company is listed on the Tokyo Stock Exchange, Fidelity is one of the brokerage firms with Metaplanet stock available for its customers earlier this year. Gerovich acknowledged this is a positive sign for the company, noting that its shareholder base continues to expand with its stock becoming globally accessible. Interestingly, Fidelity, being the largest shareholder of Metaplanet, is similar to how Vanguard is also the largest holder of the Strategy (formerly MicroStrategy) shares through its funds. However, unlike Vanguard, which refuses to allow Bitcoin exchange-traded funds (ETFs) trading on its platform, Fidelity not only lists Bitcoin ETFs but also has its own spot Bitcoin ETF (FBTC). In both cases, the firms’ exposure to the Bitcoin treasury companies is due to their customers, showing substantial interest in these companies from retail and institutional investors who trade and invest through the TradFi brokerage and investment firms. Metaplanet solidifies position as a top-five corporate holder of BTC Meanwhile, the recent development represents a positive sign for Metaplanet as the company continues down the path towards accumulating more BTC. It recently acquired 797 BTC for $93.6 million, putting the average price $117,451 for each BTC. With that move, its Bitcoin holdings increased to 16,352 BTC bought for $1.64 billion. While this pales in comparison to the over 600,000 BTC that Strategy holds, Metaplanet has quietly climbed up in the rankings of public corporate holders of BTC over the past few months and now sits at number five. Metaplanet’s new target is now to have 210,000 BTC by the end of 2027, and the company has said it would use its Bitcoin holdings as collateral to secure capital for investing in other cash-generating businesses. Metaplanet stock sees decline amidst Bitcoin profit taking Despite the positive news of growing adoption for Metaplanet, the company’s stock has sharply declined today, falling almost 8% in the past 24 hours to 1,436 Yen. The decline marks a month-long performance that has seen it fall 24.22% in value. Nevertheless, the stock is up 301% year to date, highlighting its overwhelming performance compared to several other Bitcoin treasury stocks. MSTR has only gained 53% while MARA is up 12.49%. Even BTC value has only increased by 23.69% in 2025 Metaplanet stock performance YTD (Source: Google Finance) However, Metaplanet’s recent decline in value is due to the profit taking that has caused BTC value to drop almost 4% in the past 24 hours, sliding to $116,000. With the flagship assets hitting a new ATH, several traders are already taking profit. In one instance, a long-time BTC holder moved 40,000 BTC to Galaxy Digital in what is likely a massive selloff after being inactive for 14 years. This potential sale of over $4 billion worth of BTC was enough to spook the market, with other tokens also falling in value. Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now