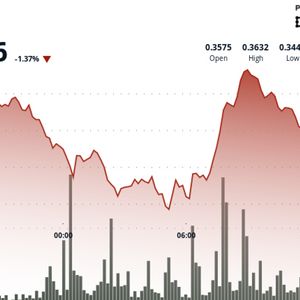

Summary I see a strong case for a rotation from Bitcoin to Ethereum, supported by whale activity, derivatives flows, and declining ETH supply. EETH underperforms spot ETFs on price but stands out with a 6%+ yield, making it attractive for income-focused investors despite higher fees. Risks include crypto market volatility, historical cycle peaks, and persistent Bitcoin dominance, tempering my bullishness with caution. Ethereum’s expanding use cases in DeFi and AI, plus likely Fed rate cuts, strengthen my conviction in EETH’s upside with a $98 price target. After gaining more than 100% since the first week of April, the ProShares Ether ETF ( EETH ) was trading at around $76.8 at the time of writing but remains below its March 2024 high of $91. Data by YCharts This thesis aims to show that this rally could continue, given that we could be amid a potential rotation from Bitcoin ( BTC-USD ) to Ethereum ( ETH-USD ). For this purpose, while also highlighting the risks, I will examine how whales (individuals, funds, or institutions that hold very significant amounts of crypto) are positioning themselves and look at crypto flows on the derivatives market. Equally important, this ETF yields above 6%, which makes sense from the income perspective since there is a strong likelihood (nearly 90% chance) of the Federal Reserve cutting rates next month. I start with crypto price action. Supporting a Rotation First, looking at the price performance since April in the orange chart below, Ether surged to hit a new all-time high of $4,946, while Bitcoin has been struggling to hold above $110K after its gains. This is despite the enactment of the GENIUS Act, which, despite primarily focusing on regulating stablecoins, can also increase the adoption of other digital assets, including Bitcoin. This situation has led one analyst to note that "BTC is exhausted ". Data by YCharts Second, derivatives activity on the CME also points to surging interest in Ether. Thus, derivatives open interest (or Ether futures volume) reached $10.54 billion on June 30, representing a 58.65% quarter-over-quarter increase, outpacing Bitcoin futures, which grew by 34.92% to $16.85 billion. This reflects heightened institutional interest in ETH, for hedging purposes and at a time when its supply has decreased. In this connection, Ether's reserves on Binance, one of the major crypto exchanges, have dropped significantly, possibly because investors are buying more in anticipation of a price recovery or for long-term holding (staking). This could also signal the onset of the Altcoin season, synonymous with a reallocation of capital from Bitcoin to other coins, including Ether. Looking further, a rotation thesis is also supported by some major on-chain moves that involve Bitcoin whales executing massive conversions from BTC to ETH at the blockchain level. Hence, one dormant whale converted 19,663 BTC (market value of $2.22 billion) into 455,672 ETH, while another one liquidated 400 BTC ($45.5 million), again to acquire Ether. Based on the above, it makes strong sense to invest in Ether, but some may argue why choose a futures tool like EETH while several cheaper alternatives like spot ETFs are available. EETH Underperforms Spot ETF Price-Wise, But Differentiates Itself Through Income First, detailing EETH, this is an actively managed ETF that seeks to provide investment results corresponding to the performance of Ether by investing primarily in futures contracts. To achieve its aim of continuously trading contracts, it charges a relatively high expense ratio of 0.95% , which includes a contractual waiver until September 30, 2025, after which it may revert to 1.00% . Here, the problem is that spot Ethereum ETFs have engaged in a fee war, with many charging significantly lower, as exemplified by the highly popular iShares Ethereum Trust ETF ( ETHA ), with an expense ratio of 0.25%, as shown in the comparison below . Seeking Alpha This means EETH faces low-cost competition from spot ETFs, which also offer better tracking accuracy (or more accurately replicate the underlying asset), accounting for ETHA's much better price performance as shown above. The reason is that futures-based ETFs tend to underperform the crypto itself because of roll costs, expense ratio drag, and contango, a market scenario where a commodity's future delivery price is higher than its current spot price. Moreover, lower fees and better price performance have favorably positioned spot ETFs for Ether exposure in the ETF space, with ETHA having garnered over $16 billion in assets under management in 14 months, compared to only $137 million for EETH, which was incepted earlier. Hence, in a market where most are flocking to spot ETFs to obtain better price appreciation, I believe EETH has more of a niche status in the sense that it prioritizes income over performance, namely its dividend yield of around 6.08% TTM, paid monthly. In this connection, unlike spot ETF, CME Ether futures are cash-settled, and ProShares’ active management generates distributable income monthly. Noteworthily, the expense ratio of 0.95% may appear relatively high but is largely offset by its above-6% yield, which, it must be emphasized, is net of expenses. Thus, according to the SEC (Securities and Exchange Commission), distribution yields are reported after fund operating expenses . Equally important, as I detail below, EETH's yield, which dwarfs the median for all ETFs by a whopping 140% , is appealing to income seekers, especially in the current macro context, with the Fed likely to shift to easing, making bond yields fall. Additionally, the ProShares fund also offers price appreciation potential from its futures exposure, meaning it deserves better. The Futures ETF Deserves Better, But There Are Risks Talking valuations, according to the chart below , it has delivered an upside of 51.5% compared to 76.7% for ETHA in the past year. Interestingly, the tracking gap highlighted, or 51.5% versus 76.7%, or 76.7/51.5, represents about a 50% capture ratio of Ether's upside (since ETHA tracks Ether). Seeking Alpha Now, the crypto was trading around $4,456 at the time of writing, and one top analyst expects it to go to above $12,000 by the end of this year, or by about 169%. This is a highly bullish forecast, and applying a high dose of moderation, let’s assume an appreciation of around 56% (one-third of 169%) to $5,940 in the medium term. Applying the capture ratio of 50% of Ether’s upside as identified earlier, EETH could appreciate by 28% (50 x 56/100), which gives a price target of $98.3 (76.8 x 1.45) based on the current share price of $76.8. Now, to justify my moderate stance, there are challenges associated with the rotation thesis, as despite being supported by recent trends, EETH faces potential headwinds from market volatility and broader economic conditions. This includes sharp price corrections, like Ethereum's 8.2% decline in a single day on August 25 , which highlights the volatility that can disrupt rotation trends. Moreover, looking at historical trends, Ether's all-time highs have often coincided with broader crypto market tops, as charted below in 2018 and 2021 (two times). In those cycles, ETH's breakout relative to BTC was followed by a broader crypto market peak, eventually followed by a slide . Data by YCharts Thus, based on the historical data, there are reasons to worry that the current cycle could follow previous trends, with Ether potentially reaching a market top rather than a sustained rotation. Furthermore, looking at Bitcoin's dominance, or its relative market share (capitalization) in the overall crypto market, despite recent declines, remains elevated at around 58.3% . Also, technical indicators, such as the Moving Average , suggest that while the short-to-medium momentum is weak (price situated below the 10-day, 50-day, and 100-day MAs), the long-term trend is still bullish (price above the 200-day MA). Hence, despite short-term pressure, BTC remains in a long-term uptrend. Confirming the Bullish Case for EETH Now, despite these risks, I remain bullish due to Ethereum's role in innovation, namely, decentralized finance and AI, as well as rate cuts supporting the income rationale, both of which support the rotation away from Bitcoin. First, Bitcoin’s value is primarily driven by its role as a store of value, meaning it is prized for its scarcity and also adopted as a hedge against inflation. In contrast, Ethereum’s value is also determined by its status as a blockchain platform for application development, implying it should also be valued by usage, or the network activity created by its supporting role in decentralized applications, like DeFi (decentralized finance) protocols, NFTs (non-fungible tokens), and increasingly, AI-powered smart contracts (intelligent apps integrated into blockchains). Now, AI and Ether convergence, potentially leading to the emergence of autonomous AI agents (agentic AI) for transactions and settling payments, could become a key differentiator with BTC as blockchain adoption grows. Talking risk mitigation, these expanding Ethereum use cases could help to shield its price from market volatility as its value becomes less associated with investor sentiment (like whales buying or selling), as is the case for BTC. Second, as the Fed lowers interest rates, EETH's passive income stream becomes particularly attractive. To this end, the chart below shows that when the U.S. Central Bank aggressively cut rates to zero following the COVID pandemic, as from March 2020, Ether outperformed Bitcoin. Conversely, it underperformed when rates were frantically raised in mid-2022 to contain inflation. Seeking Alpha Then, logically, if monetary policy is further loosened, one can expect more BTC-to-ETH conversions. In conclusion, this thesis has painted a bullish picture for EETH, whose shares could rise to $98, or $7 above its 2024 peak. Some may view this as an unambitious target given the strong case made for the rotation to Ether, but this includes moderation, mainly due to the rotation not proceeding smoothly and the futures strategy's tracking inefficiency. Also, one must not ignore that inflation may raise its ugly head because of the effects of tariffs, while there is a high level of uncertainty concerning administration policies, exacerbated by the extraordinary political pressure put on the Fed. Still, the aggressive lowering of rates remains a priority of the current U.S. administration in its attempt to increase spending and raise the GDP growth rate. In these circumstances, the capital flows from Bitcoin to Ether should be sustained over the long term, but amid risk-off episodes that may negatively impact crypto markets broadly. .