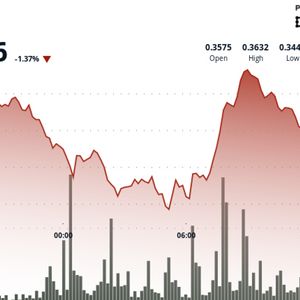

Bitcoin (BTC) last broke through $124,000 in mid-August, before entering a downtrend. At this point, BTC has fallen below $110,000, with analysts believing the current $107,000-$108,000 levels to be critical for its future price action. While Bitcoin has been unable to escape the downtrend it has entered since reaching a new ATH of $124,000, we have entered September, when the FED is expected to make the first interest rate cut of 2025. At this point, as investors leave their hopes for a rise to the coming days and months, let's take a look at the answers to the questions: “Is Bitcoin liking September? How did it perform in previous Septembers?” How Did Bitcoin Perform in Previous September Months? When we look at Bitcoin's performance over years and months, we notice that declines are concentrated in certain months and increases are concentrated in certain months. When we look at the Bitcoin monthly return chart above, we see that January, March, August and September are generally the months of decline, while February, July, October and November are the months of rise. At this point, when historical data is examined, Bitcoin closed September with an increase in only 4 of the last 12 years, while it closed September with a decrease in the remaining 8 years. According to the data, in September, when BTC closed in the green, the increase rates were small, such as 3.9%, 6% and 7.2%. In the face of these historical data, analysts and investors describe September as the worst-performing month of the year, and it is predicted that September this year will also be a down month. While expectations for a rise are bearish, it's difficult to predict which direction Bitcoin's price will move. The possibility of the Fed cutting interest rates, which have been held steady since the beginning of 2025, in September, and the expectation of seeing an upward trend in BTC and the crypto market with the first interest rate cut of the year, are also high. At this point, some analysts predict that Bitcoin and the cryptocurrency market will experience a broader recovery, given the current structure. An analyst with the pseudonym ZYN noted a bullish divergence in the weekly RSI. Accordingly, despite the price pullback, the lack of a similar decline in the RSI suggests buyers are still active in the market. “This data isn't hope, it's reality,” the analyst said. “If the current level holds, a new ATH is on the table within the next 4-6 weeks.” While September is often negative for Bitcoin, historical data suggests that October and the final quarter of the year were strong for Bitcoin. BTC ended the month with an 83% increase. This is why October is known in the markets as the “Uptober” bullish month. *This is not investment advice. Continue Reading: Will the "Bitcoin Doesn't Like Septembers" Story Continue? Will There Be Another Leaf Fall? Here Are the Historical Data and Expectations!